Outgoing governor Glenn Steven has told The Australian and The Wall Street Journal parents of his generation would find themselves helping their children into the housing market as that may be the “only way” they can get their foot in the door.

“Of course, means that for people of my age, that the wealth we think we have in our house, actually, we don’t have quite as much as we thought because we’re going to have to give some of it to the next generation,” he said.

And new research shows we are giving to our children.

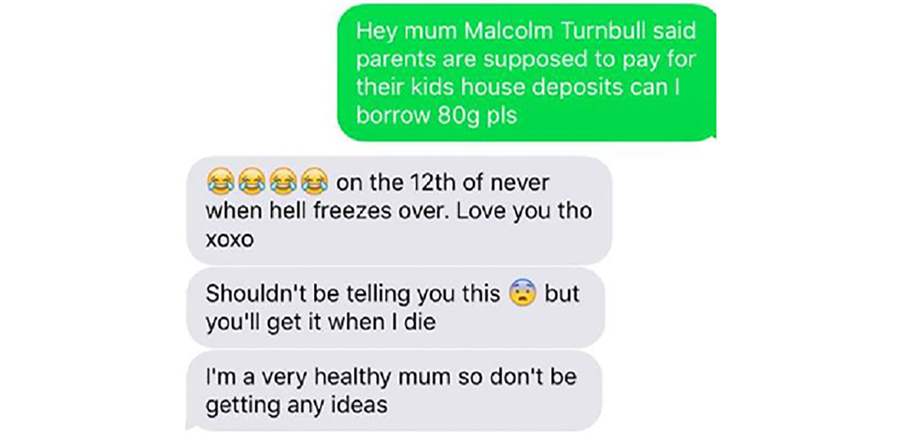

The ‘bank’ of mum and dad

With loans for first-home buyers at an all-time low, a recent Housing Affordability Report by Bankwest Curtin Economics Centre[1] showed that 38 per cent of Gen Y households that owned their home had received help from parents or grandparents.

Many banks have also introduced Family Guarantee loans for parents who want to use the equity in their home as collateral for their children.

But with parents looking ahead to their own retirement – or already out of the workforce – it could prove a risky investment.

According to industry super fund-owned bank ME[2], 28 per cent of their mortgage holders who had financially helped a family member buy a home ‘within the last five years’ said their generosity had affected their level of comfort in retirement, from 21 per cent of those who gave financial help ‘more than five years ago’.”

Perhaps even more worryingly is the rise in the amount being loaned or gifted by family members to buy property. Their survey showed an increase from an average of $27,000 ‘prior to the last five years’ to $42,000 ‘within the last five years’.

Risky business

Parents can find themselves liable for loan repayments if their children end up in financial strife. While many lenders now offer limited liability guarantees, you would still be responsible for part of the loan if your child defaulted.

And what if you don’t like or trust your child’s partner? In a split, they would be able to claim an equal share of any gift or loan. In some cases, parents even take out a second mortgage for their children just to avoid a partner being able to claim the property later.

Interest rates are also sitting at record lows, but any rise could result in a significant jump in repayments.

You can also jointly purchase a property but this also increases your liability if something goes wrong.

Another option is a gift, but any amount over $10,000 for a single person or couple and $30,000 over a five-year period could affect future pension entitlements for five years.

And the bottom line is …

Of course, these options often rely on parents actually owning their own home in the first place. People aged 65 to 80 owed an average of $158,500 on their own mortgage in 2015[3].

Mr Stevens adds in the interview: “If we come from a rental household ourselves, then we’re not going to have that equity to pass to the next generation, and certain types of disadvantage, therefore, are going to be perpetuated into that next generation.”

The hard truth is while we may want to give our children a roof over their heads, we might not just be in the financial position to do it.

Would you help your children to buy a home? Let us know in the comments below.

Watch the video of Glenn Stevens here.

[1] Bankwest Curtin Economic Centre ‘Keeping a Roof Over Our Heads’ BCEC Housing Affordability Report 2016 – Focus on Western Australia Report Series, No. 7 June 2016

[2] ME Media Release – ‘20% of families ‘shelling out’ to get the kids into a first home’ – May 6, 2016 (Survey conducted via RFi Group in March using an online survey method. Survey completed by 2,000 mortgage holders.)

[3] ING Direct media release: ‘Australians’ growing property debt in retirement calls for super planning’ – June 22 2016 (analysis is based on ING DIRECT’s own customer base. ‘Retirement years’ considers those customers aged between 65 and 79.)