ANZ Bank has come to the (rightful) conclusion that women get a raw deal on super, so they are kicking the can with an extra $500 a year. But it’s against the law because it discriminates against men.

To implement their scheme, ANZ had to use a “special measure” provision in anti-discrimination legislation in most states.

In NSW, there was no measure so they had to apply for a special exemption from the Anti-Discrimination Board.

The bank is also making super contributions for all employees on any paid or unpaid parental leave.

This followed their own research which found women earned an average of $700,000 less than men over their lifetime[1]. That’s enough to buy a house!

Taking a stand

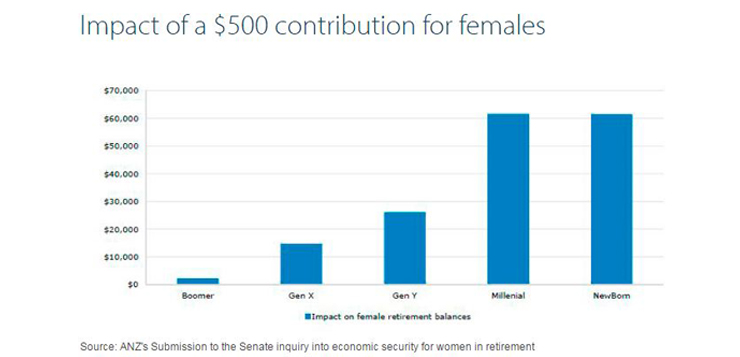

ANZ uses the example of Sarah, a 20-year-old who earns $30,000 a year working full-time (that’s $577 per week before tax – poor Sarah!) Say she works 30 years full-time and 15 years part-time throughout her career on 9.5% super – her balance at 65 would be $635,000.

With the extra $500 a year, her balance would total $715,000. That’s an increase of $80,000 – nearly 97% of what she would have had if she hadn’t worked part-time.

ANZ has around 21,000 employees in Australia – that’s a lot of women who could potentially benefit.

They aren’t the only ones to introduce such schemes. Westpac were the first company to pay super during unpaid parental leave. Property group Dexus and actuarial firm Rice Warner also offer the same incentive.

The need for reforms

But while these measures are all welcome, there is still the underlying problem that the reason women have less super is because we are paid less over our lives than men.

Women make up 42% of the workforce but currently earn 17.2% less than men according to the ‘Gender Pay Gap – Over the Life Cycle’ report by the Australian Council of Trade Unions (ACTU).

As a result, ANZ estimates that women actually require 10 per cent more superannuation than men if they retire at 65.

Last week, the Government said it will introduce the Low Income Super Tax Offset (LISTO), a maximum $500 rebate for part-time and low income earners, the majority of which are women.

This is not enough.

Why not amend the Sex Discrimination Act to allow employers to legally pay more super to women?

It’s what a Senate inquiry into women’s economic security in retirement recommended earlier this year.

An extra boost

The ACTU also proposed to the same inquiry to increase compulsory super contributions for women by 2%, a move the Senate Economics References Committee was reluctant to support.

It has been done before though. Rice Warner began paying its female employees an extra 2% in super in 2013 – only with approval from the Human Rights Commission.

They had just under 40 employees though – it’s a start, but a small one.

Industry groups say the measures would be too hard to implement for smaller businesses and discourage employers from hiring women. Both valid points.

But the reality is the aged pension is set to blow out to $50B in coming years, with most going to women.

If we don’t close the super gap now, all of us – Government, business and taxpayers – will bear the cost.

ANZ are also offering free financial advice to female customers if they have less than $50,000 in superannuation. Would you take up their offer? Let us know your thoughts below.

You can also watch ANZ’s video on ‘Why we have financial inequality’ here.

https://www.youtube.com/watch?v=EvOPM9r19Kg

And if you missed it, watch ANZ’s ‘Pocket Money’ video for their #equalfuture campaign here and see what happens when girls are paid less for their household chores than boys.

[1] ANZ Women’s Report: ‘Barriers to Achieving Financial Gender Equity’ 2015