If you were an investor, where would you put your money – senior care or a chain restaurant? If you said seniors, you’d be on the money – literally.

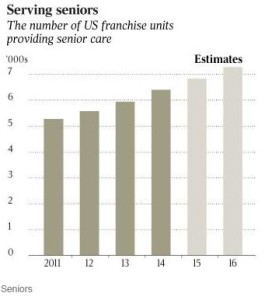

Home care is proving a boon in the US, with the number of franchises climbing 40 per cent from 5,200 to 7,200 in the past five years according to this piece in The Wall Street Journal.

That’s a huge leap – and the numbers are only set to rise.

A good investment

Around half of the home-care agencies in the US are now franchises, up from only one-third five years ago. The senior home-care sector has also grown by 6.6 per cent annually, much faster than the overall franchise industry’s 2.6 per cent rate.

An ageing population, plus low start-up costs, is fuelling the growth. An initial investments in the home care will only cost you an average of $US115,000 – in contrast, investors have to shell out nearly $US1 million for a sit-down restaurant.

“Of all the sectors we look at, it has one of the highest returns on investment,” said Eric Stites, chief executive of Franchise Business Review.

“Of all the sectors we look at, it has one of the highest returns on investment,” said Eric Stites, chief executive of Franchise Business Review.

Senior care is also delivering more ‘bang for your buck’ with the average return $US118,000 a year compared to $US82,0000 for the franchise industry as a whole. Home healthcare and personal-care aides are two of the fastest-growing occupations in the States too.

So are we likely to see the same in Australia?

The short answer: yes.

A huge potential market

Changes to home care packages set to be introduced here in February 2017 mean consumers will soon be free to choose their own service provider. Previously, there was no option to choose your own care.

With most Australians wanting to stay in their homes and ‘age in place’, the demand for in-home care is already skyrocketing.

In 2014-15, only 7 per cent of Australians aged 65 years and over were in residential aged care, while 25 per cent accessed some form of support or care at home[1]. That’s around 925,000 people – a huge market.

Australia has already seen several American home-care operators set up shop here, including Senior Helpers in 2011 and Home Care Assistance just last year.

Home Instead Senior Care has been one of the early pioneers and now has nearly 1100 franchises across 12 countries including 32 in Australia since 2005.

A new direction for providers?

Home care is also developing into an attractive prospect for village and aged care operators.

In the 2015-2016 financial year, 112 new businesses applied as home care providers to the Department of Health with 77 being approved.

Just recently Sydney private equity group Quadrant bought 50 per cent of Western Australian-based St Ives Home Care for a rumoured $150 million after a series of lucrative village and aged care investments.

The question is: do you want to be looked after by a private equity group?

[1] 2014-15 Report on the Operation of the Aged Care Act 1997 – Department of Health