You could die or be incapacitated before you get really old. Do you know who would care for you or where you would live if you were no longer able to look after yourself?

If you don’t have the answer, you’re not alone. A recent study by charity Independent Age[1] found many older people avoided talking about incapacity and ageing, particularly discussions about end-of-life care.

The research, which surveyed about 2,000 people, found nearly two-thirds of people over 65 hadn’t talked to their families about their care preferences. Over 25 per cent said they had no plans to bring it up in the future.

So why do we need to have this conversation?

A conversation for the dinner table

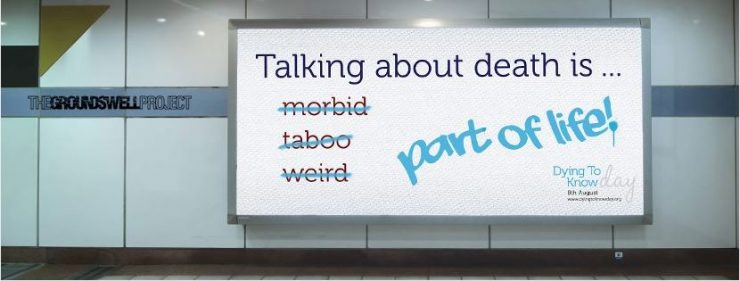

The truth is we will all die one day and accidents and unexpected illness can happen to anyone at any age. August 8 was Dying to Know Day, a project created by The GroundSwell Project to encourage people to plan for their end of life and dispel the myth that talking about death is strange or morbid.

While many of us find death a difficult issue to bring up with family and friends, this isn’t just about writing a will or having the money to pay funeral costs. If you want your wishes for end of life care and death to be respected, you need to speak up now.

This is especially important for palliative care, when people may no longer be able to make health decisions for themselves.

While most Australians would prefer to die at home, around half will die in hospital. Another third will pass away in aged care[2].

Planning a ‘good death’

Preparing for end-of-life care and death will also save your family from deciding on your care, housing and financial matters when they are stressed or grieving. It will also relieve their concerns they might not be following your wishes.

With the number of Australians who die each year set to double in the next 25 years[3], it’s the conversation we may not want to have, but certainly one that none of us can avoid.

We recommend you check out agedcare101 here for a detailed list of legal documents and here in a quick guide:

Planning for death – what you should do

- Write a will and seek advice to make sure it is legally binding.

- Set up an advanced care plan for your family and doctor.

- Find all your original legal documents including your will. Make certified copies of each and store them securely.

- Make sure you have an up-to-date list of personal details such as bank accounts, credits cards, super, health insurance, medical records etc.

- Appoint an enduring guardian who can make decisions for you regarding medical treatment, pain management and palliative care.

- Make plans for your final send-off including any burial or cremation requests.

- Sort out any outstanding financial matters and make sure money can be easily accessed if you are paying for your own funeral.

Need any more reasons to make an end-of-life plan? Watch this great video by The GroundSwell Project here.

[1] ‘Conversations about Care’ survey by ComRes for Independent Age – April 2016

[2] Grattan Institute’s ‘Dying well’ report by Hal Swerissen and Stephen Duckett – September 2014

[3] Grattan Institute’s ‘Dying well’ report by Hal Swerissen and Stephen Duckett – September 2014