If you’re expecting to use your home to finance your retirement, you may be in for a rude shock. That’s according to the latest findings out this week from global bank HSBC.

Their ‘Future of Retirement: Generations and journeys’ report found 26 per cent of Australians expect to use property to foot their retirement bill; in reality only 8 per cent do.

So the truth is most of us won’t be downsizing or selling our homes. Why not?

Always look on the bright side of life

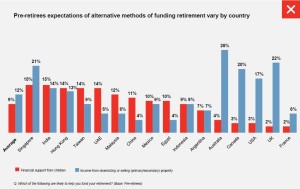

The survey of 1003 Australian workers and retirees revealed Australians were the most optimistic that housing would fund their retirement, compared to just 12 per cent globally.

Participants also became more confident that property would help them the closer they got to retirement age.

The Australian belief that “she’ll be right” may prove misguided though. While the survey found 66 per cent expected to move into a smaller home in the future, most don’t downsize in early retirement – they just hang on but with little or no money.

Counting the costs

Most Australians want to stay in the same area when they retire, but depending on where you live, there aren’t always suitable smaller homes available.

There are also the costs of moving house, paying taxes and stamp duty fees and making any renovations.

Most people also put off downsizing for as long as possible, but if they don’t maintain the property or can’t afford to, they often find the value has gone down when they do want to sell.

Start adding up the figures and it’s easy to see why we end up ageing in place.

From boom to bust

Then there’s our booming housing market to consider. While prices continue to rise, particularly in the capital cities, relying on property in retirement seems to be a safe bet.

But with the latest data showing housing prices starting to slow, the future may not be looking so bright.

Interestingly, the report also highlighted while only 32 per cent of participants believed they would rely on the Age Pension, 48 per cent actually did.

Perhaps a timely reminder it’s never too early to start saving for your retirement.