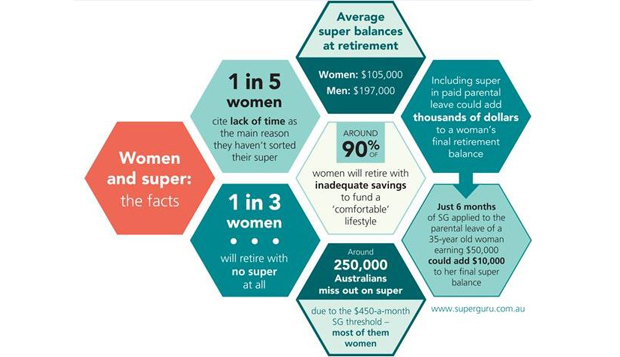

That’s a difference of $154,350. Around 60 per cent of women aged 65-69 have no super at all[1].

Can you believe it? It’s a shocking statistic, especially when you consider most women can expect to retire earlier and live longer than men.

Do you know how much money you need for a comfortable retirement? For a single person, it’s $545,000 – for a couple, $645,000[2].

This is not what most Australians have in the bank.

Women left behind on contributions

The situation is even worse for women, who are more likely to have worked part-time and taken time out of the workforce. While some women can try to make up the difference by salary sacrificing or making extra contributions, not everyone can afford to do this.

A Senate report from earlier this year, fittingly titled ‘A Husband is Not a Retirement Plan’ showed women, particularly single women, had the highest risk of poverty, homelessness and housing stress in retirement[3].

Most women are set to outlive their super savings. This will leave them to rely on the Age Pension and further blow out its cost to taxpayers as the population ages.

Is the Government doing anything to stop this?

The Federal Government promised on Wednesday to introduce the Low Income Super Tax Offset (LISTO), a rebate of up to $500 for part-time and low income earners who pay more tax on super than their personal income.

At the moment, men receive 65% of tax concessions compared to 35% of women.

“These lop-sided tax breaks disproportionately benefit a small number of Australia’s wealthiest, highest income-earning men in no need of government assistance to help save for their retirement,” David Whiteley, Chief Executive of Industry Super Australia said[4].

“If we fail to meet this most basic standard of fairness, two thirds of single women retiring between now and 2055 will retire below a comfortable standard, and more than half of women currently aged 25-29 will retire on incomes below a comfortable standard,” he added.

The need for reforms

It’s certainly a move in the right direction, but more needs to be done.

The Senate report also made a number of recommendations to tackle the gap, including:

- guaranteeing super be paid under the Commonwealth Paid Parental Leave Scheme

- getting rid of the $450 per month super threshold

- keeping the low income super contribution scheme

- increasing super to 12 percent as soon as possible.

It also recommended changing the Sex Discrimination Act to legally allow employers to pay more super to women.

One thing is clear. The Government needs to keep working to make our super system fairer now.

To be continued next week – find out what some people are doing to bridge the super gap.

[1] ‘Superannuation account balances by age and gender’ – Ross Clare, Director of Research ASFA Research and Resource Centre December 2015

[2] ‘Reduced cost of living for retirees: ASFA Retirement Standard March quarter’ media release –

Association of Superannuation Funds of Australia (ASFA) June 2 2016

[3] ‘A husband is not a retirement plan’: Achieving economic security for women in retirement –

Senate Economic Reference Committee April 2016

[4] Industry Super Australia media release: Superannuation Tax Reforms A Priority For The New Parliament – Women’s Super Now 79% Less Than Men’s On Retirement – August 31, 2016